A Guide to Understanding and Navigating Volatility

A few months ago, I went to a bachelorette party on an island near Cancun with a group of fourteen girls (half of which were North Carolina Panthers Football team cheerleaders).

The first day was incredible, starting with an ocean front, pink pool party followed by a night of dancing in the town. The bride’s sister even performed “Proud Mary” at a beach bar and received a standing ovation leaving our whole party in tears. By this point we were all on cloud 9 and I was “bullish” on the weekend.

The next morning, we all met in our Airbnb’s kitchen to cook breakfast tacos. The day was perfect, no one was too hungover, we were talking, playing music and dancing around the tables when all of a sudden the bride screams, “MY TOOTH IS GONE!!”

No one knew how to react aside from utter shock. Her sister then tried to lighten the mood by saying “Someone get this girl a Tic Tac,” which warranted no response from the bride. I then asked, “Do you think you may have swallowed it?” She immediately responded, “yes – I knew that chunk wasn’t just a piece of bacon”. So we did what needed to be done… brought her to the bathroom to cough that puppy up.

20 minutes later of utter silence in the kitchen, she emerged from the bathroom saying, “I GOT IT!!!” The kitchen erupted in ecstasy and the mood started to build again until the bride said, “Now how am I going to get this back on?” The mood subsided once more and we all started googling the nearest dentist offices and DMing her dentist back in Charlotte until another girl said, “I’ve got nail glue – let’s just pop it back on. Also [name] is in dental school, so she can do it!” (Luckily it was a Veneer, so this was actually a feasible option).

15 minutes later, the bride and dentist walked downstairs, the tooth was back on and the party raged on. So, that leads me to today’s topic – volatility – because ups and downs are inevitable, but it doesn’t have to ruin the party.

WTF is Volatility?

Volatility is the degree of variation of a trading price series over time. In other words, it measures how much stocks and indexes go up and down over a period of time.

Why is it important?

Markets are volatile. Whether you’re talking about the stock, crypto, housing, or any market, they all experience ups and downs. Ever wonder why the stock market graphs look more like bumpy EKGs and not a straight line? Volatility.

Volatility is also important because it is the main cause of market risk. When people talk about the markets, they will always warn you about market risk, because stocks (and crypto) don’t always just go up (no matter what meme accounts tell you).

What do the Bachelorette and Volatility have in common?

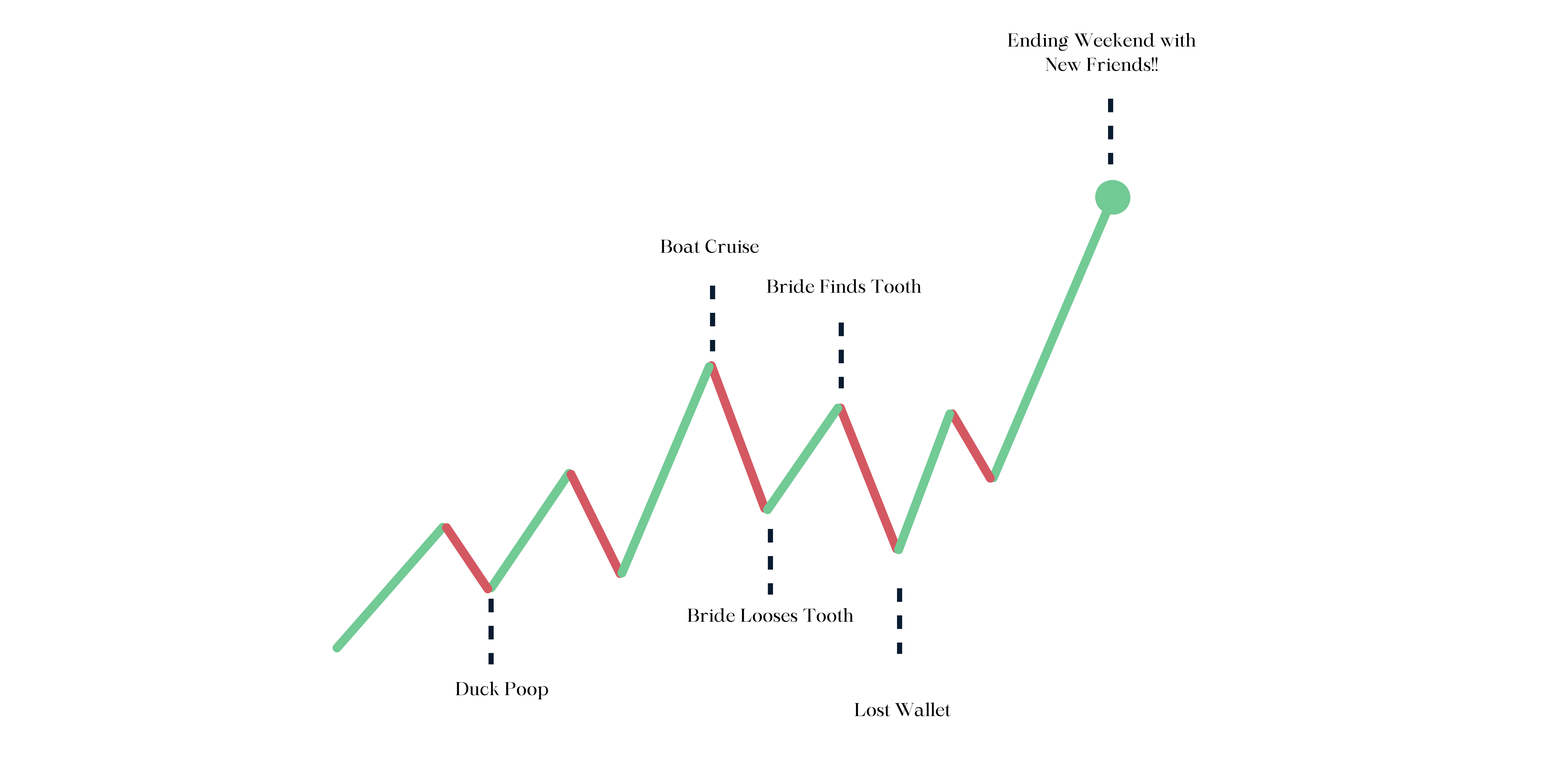

1. Ups and Downs – For the most part, the bachelorette was a perfect weekend. However, there were a few ups and downs. We had a tooth go missing, some tears, someone got pooped on by a duck and many bruises, but we still had one of the best weekends of the year. If you were to make our weekend into a graph, it would most certainly have a few bumps but overall ended up in the green. Volatility is all about prices going up and down.

2. Risk – Going to any bachelorette party is inherently risky. You get a group of girls together that may or may not get along, add a bit of alcohol and you have a recipe for some drama. Volatility yields market risk because with changes of stock prices, you have periods where you may or may not be winning. That being said, risk doesn’t mean you shouldn’t go to the party or invest in the market at all. It just means you need to prepare for it. In our case, we had nail glue to navigate a downturn.

3. They Can Be Scary – I’m not gonna lie, when the bride lost her tooth (pictured above), I thought all hell was about to break loose. It was only day 2, we were about to do another photoshoot with all the girls, and the poor thing was crying, “I look like Gollum!” For a minute there, I wasn’t sure the weekend could recover. Volatility can feel equally scary. If you have your money invested, there will be days your account is in the red and you feel like you might not recover. However, in life and investing, drama and volatility are natural – it’s how you respond that matters.

How do you deal?

- Understand Your Risk Tolerance – Before navigating market risk and volatility, you should understand your personal risk tolerance. Think about:

Your Goals: We all have different goals in life and different plans for our money. If you want to buy a house in the next few years, have a wedding, or travel for a year, your risk tolerance may be a bit lower.You might need the liquidity in the more immediate term and you don’t want to be selling in a downmarket to make your long-awaited dreams come true. But, if your goal is to create significant wealth in the long term, you may have a higher risk tolerance and target a more aggressive portfolio.

Time Horizon: The best defense against volatility is time. More time means that you can generally tolerate more risk. For example, if you are in your 80s, you have a smaller time horizon to make up for market losses, so you may want to consider a more conservative portfolio. If you are in your 20s, you have a much longer time horizon because your portfolio has more time to ride out volatility over the long-run. Therefore, you might benefit from taking on a more aggressive portfolio strategy.

Portfolio Size: While I’m not saying you can’t be the next Mark Cuban or Kylie Jenner, you may currently not be quite as flush with cash to invest and therefore, less willing to take big risks (and incur big losses). Think about it this way, if you were to lose $1 Million, you might have to work really, really hard to pull yourself out of the situation. If Kylie lost $1 million, she might not even notice. Therefore, Kylie might be able to take more risk than you, simply because she has more assets.

Comfort Level: Goals, age, and portfolio size aside, your comfort level is also a key factor. The best investment plan is the one you can stick with. Some of you might have a braver stomach than others when it comes to investing, because the fact is – there will always be volatility in the markets. It’s about how comfortable you are with that. Some will naturally say, “risk on!!” Others will say, “no way, I can’t tolerate the red.” You just have to find the level of risk you’re willing to accept. Also keep in mind that greater risk can yield greater return, but only if you’re also able to bear the emotional cost of riding out volatility.

Note: Depending on your risk tolerance, your portfolio will be constructed differently. If your risk tolerance is low, you will invest more conservatively (more bonds than stocks & generally lower returns). If your risk tolerance is moderate, your portfolio will be more balanced (a combo of stocks and bonds). If your risk tolerance is high, your portfolio will be more aggressive (generally more stocks than bonds, higher risk positions, and the possibility of greater returns). See the graph below showing the difference of wealth creation by risk and average return with no investing being the most conservative.

- Hedge – When preparing for volatility, many investors hedge their portfolios. That means they take an investment position intended to offset potential losses. Some hedging strategies are investing in gold, crypto, bonds, and real estate (remember my article about hedging for inflation?). Regardless of the strategy, it’s all about offsetting losses. In my personal portfolio, I just try to stay the course and diversify my investments so when some suffer, others can pull the weight. And in terms of the bachelorette, you could say we hedged our risk with nail glue and having a dental student with us.

- Think Long Term – When the bride lost her tooth, one of the things I told her was “you are still going to marry your dream boy and your sister is great at Photoshop, so the tooth doesn’t matter.” I tried to get her to think long term rather than about the immediate chaos. When investing, you should also consider doing the same. Why? Well, The average annualized total return for the S&P 500 index over the past 90 years is 9.8 percent and that is including the 2008 crisis AND the Great Depression. Point being – the market will experience dips but overall goes up over time. (This does not mean all stocks go up over time – this means indexes of the entire market generally go up).

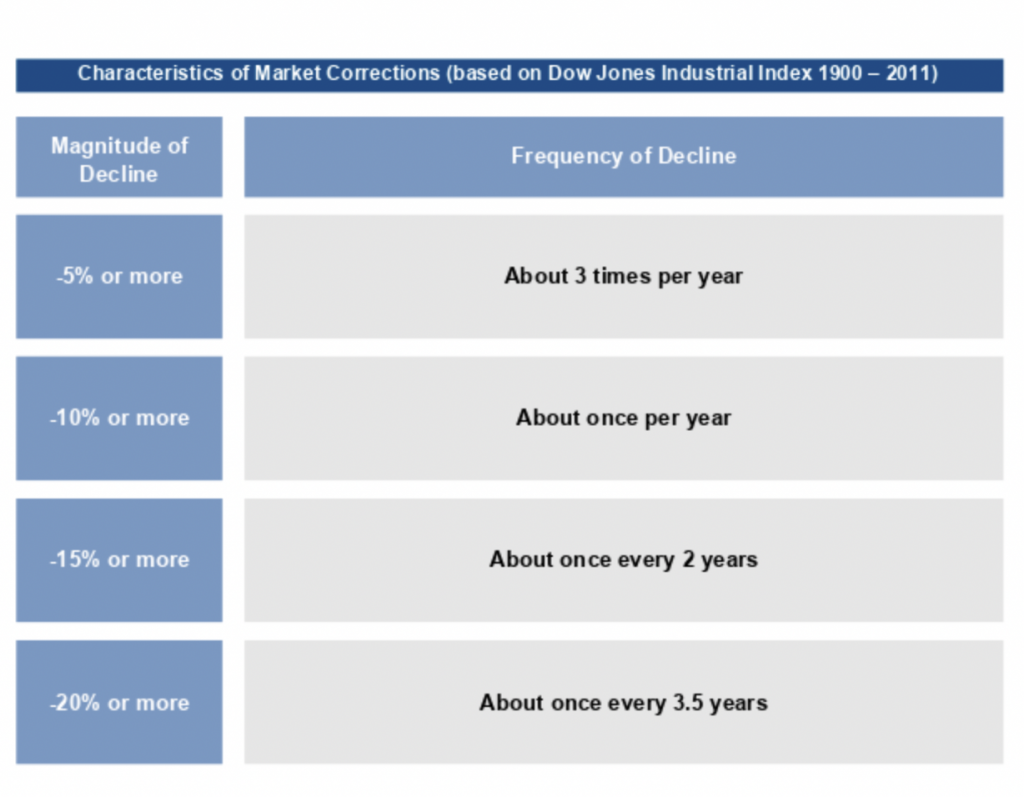

- Don’t Panic – Sh*t happens. A bride literally LOST HER TOOTH on her bachelorette, but our girl stayed calm in the face of disaster and her merry weekend made an epic rally. Markets inevitably dip (see chart below). Every year, markets decline. This graph shows a hundred-year time horizon with all the peaks and valleys.. Next time the market takes a dive, remember to zoom out, ride the waves, stay the course, and enjoy the ride.