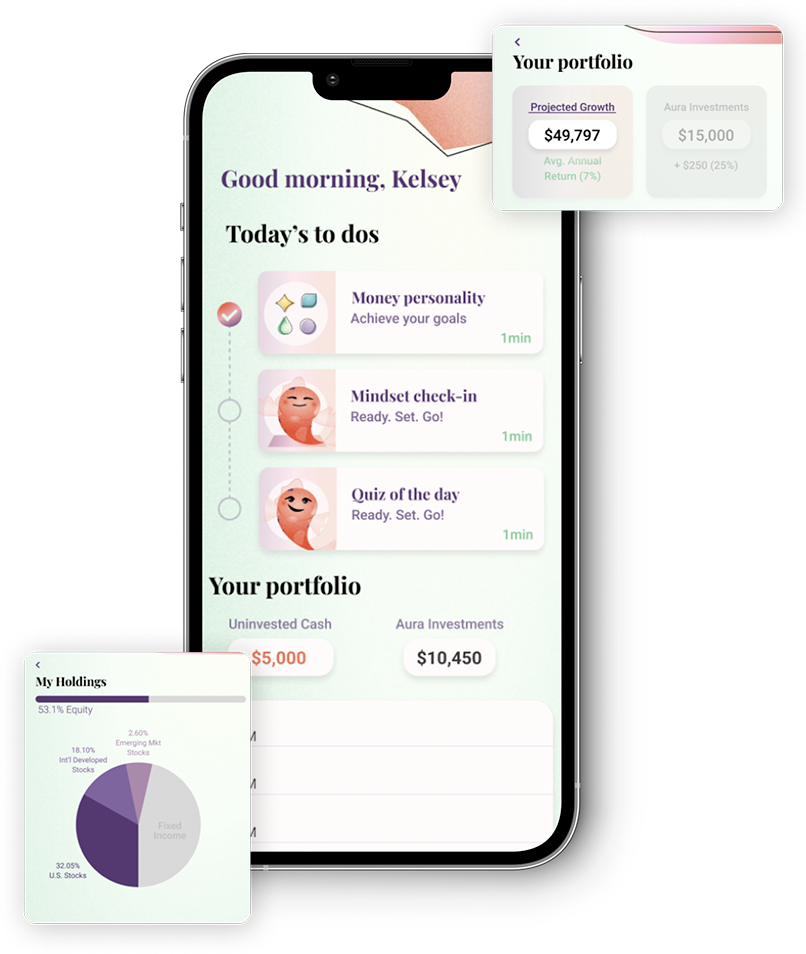

How we Invest

Your Own Stock Index

We offer direct indexing – a feature typically only available to six-figure minimums. This means you’re directly holding shares of the stocks in your portfolio.

We believe the best investment plan is the one you can stick with, and the one you can stick with is the one you believe in.

Through direct indexing, we:

- Remove hidden fees; While many robo advisors appear to have low fees, many hide high ETF expenses. With Aura, you have full fee transparency.

- Provide efficient tax loss harvesting. All Aura portfolios have automatic tax-loss harvesting, which can help enhance your portfolio’s performance.

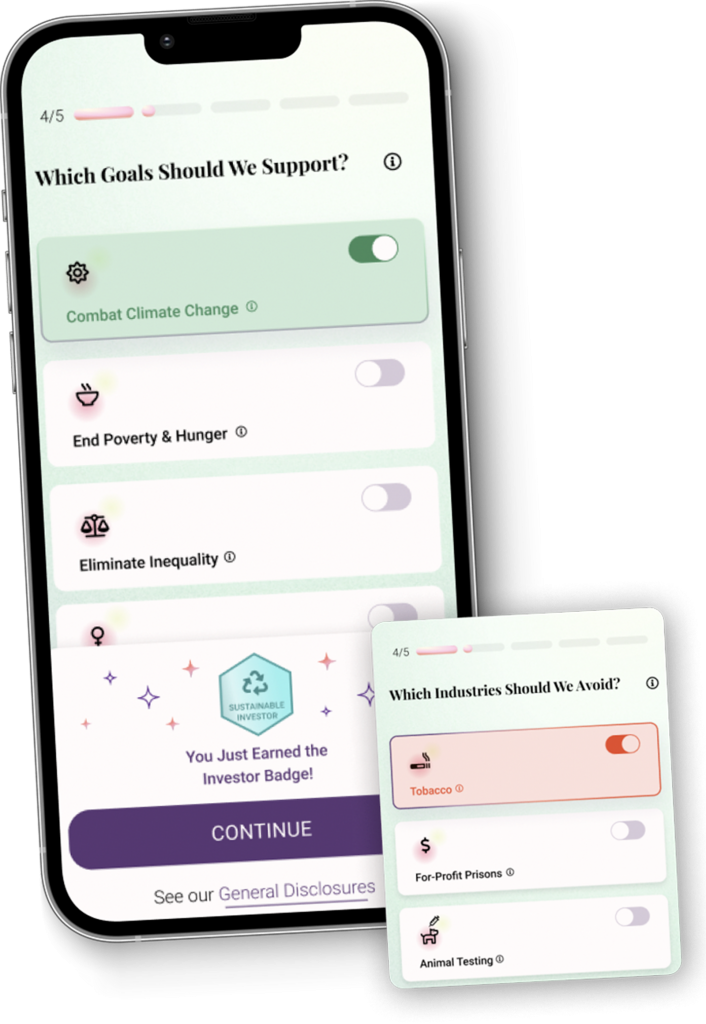

Socially Conscious Investing

We help you align your investments with your values with our customizable ESG (environmental, social and governance) screens. Don’t want to invest in tobacco or oil, just filter it out.

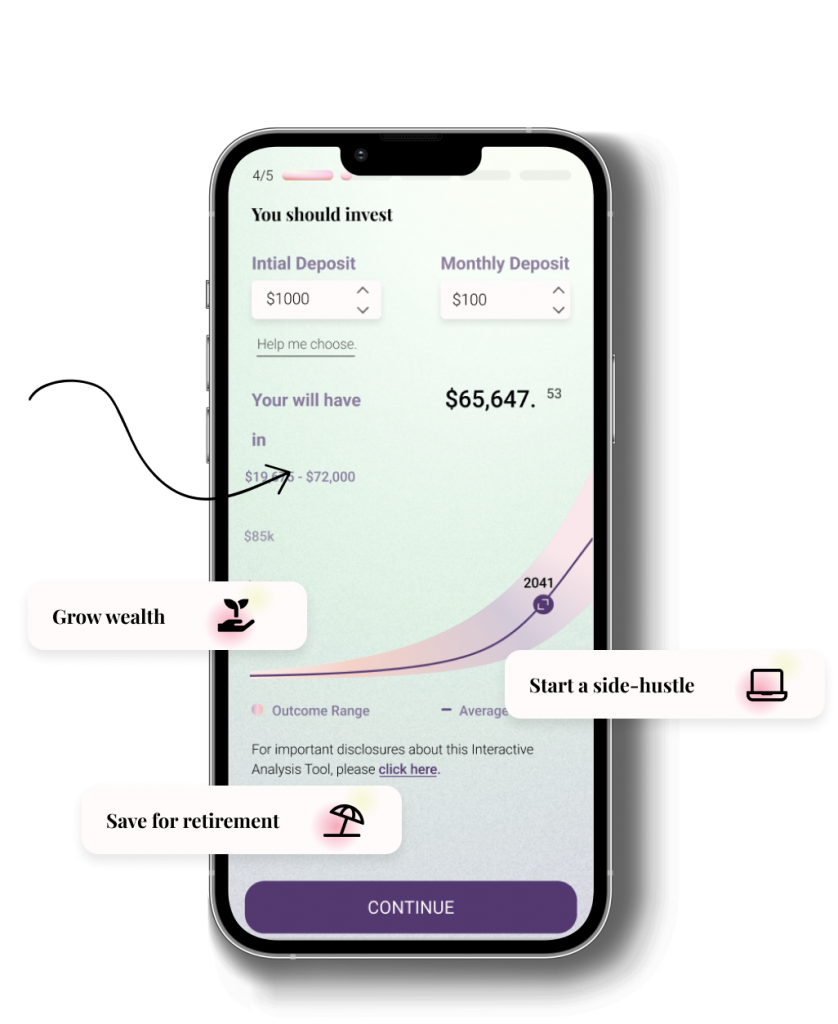

No “One Size Fits All”

We’re offering the best in personalized, expert support and algorithmic investing.

Since 2008, Robo-Advisors have leveraged technology to help individuals generate passive wealth. However, their one-size-fits-all, “set and forget” approach has done little for managing financial anxiety and in fact, can contribute to harmful avoidance behavior.

At Aura, we believe financial management is deeply personal and should fit you.

Benefits You Won’t Find Elsewhere

Features |

Aura |

Ellevest |

Wealthfront |

Vanguard |

|---|---|---|---|---|

| Retirement Accounts | ||||

| Socially Conscious Investing | ||||

| Goal Setting | ||||

| Money Mindset Coaching | ||||

| Design your own index | ||||

| Individual personalization | ||||

| Adv. Tax Reduction | ||||

| Large Expense Optimizer | ||||

| Savings/Investing Optimizer | ||||

| No hidden ETF Fees | ||||

| Interactive Lessons | ||||

| Connect with users like you | ||||

| On Demand Support/Coaching | ||||

| Curated content based on your needs/goals |

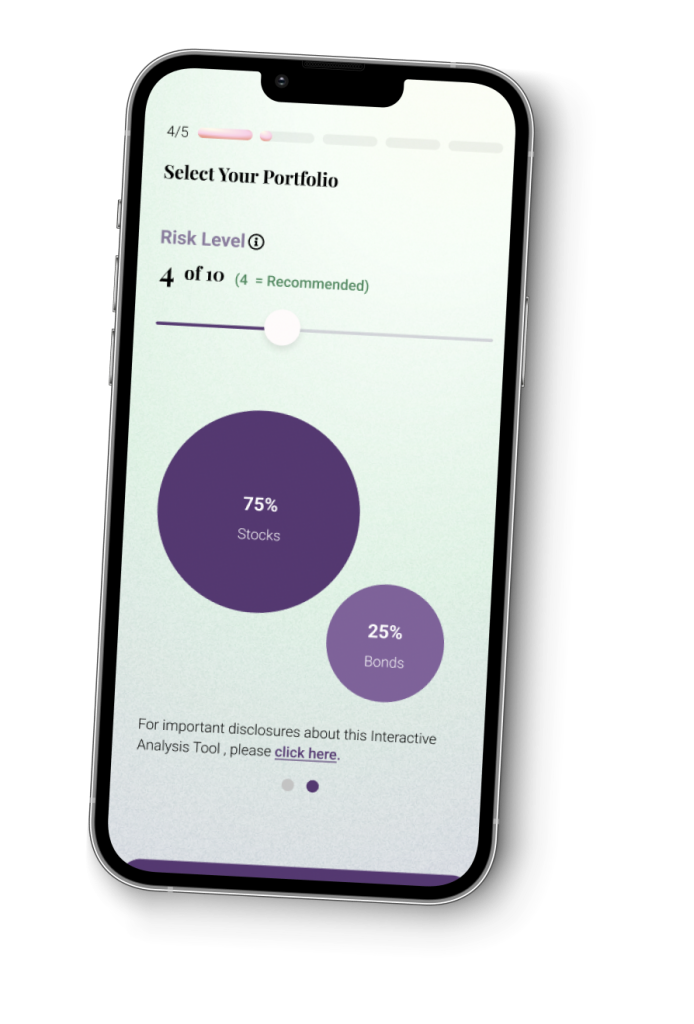

A Diversified Approach

- Three primary asset categories are equities, fixed income, and cash

- Those can be further classified by geographical region

- The right mix of these is key to your long-term return

Stocks

- U.S.

- International Developed Markets

- Emerging Markets

Fixed Income

- U.S. Treasury

- U.S. Corporate

- Securitized & Other