Note: This is a response article to Boyfriend’s and Getting Through a Bear Market. I’d recommend reading this first if you haven’t already.

Story Time

When I was younger, I played football with my brothers and our neighbors in the alley almost every weekend. You can think of it as my “bull market” era because I was always winning (the perks of being the oldest, tallest and fastest). However, one summer, everything changed.

My brothers surpassed me in height along with the neighbors and I suddenly found myself in “bear market” territory – losing endlessly and feeling like I’d never win again.

One afternoon, I told my dad about it and all my frustration. He said, “Kelsey, sometimes the best offense is a good defense.” He explained that, in order to stop the opposing teams from scoring, you need a stronger defense strategy. While I wasn’t winning the games by a landslide, I started to gain back confidence as the games were no longer ending in a blowout. Over time, as our defensive strategy paid off, we were even able to score more points as our team was no longer suffering from low morale.

WTF are you talking about?

The best offense is a good defense. And right now, investors are playing defense. You may feel as though the game has been lost with your investments in the deep red, but I can assure you, there is still hope to win the game. You just need to hang on, because in the wise words of Bear Bryant, “Defense wins championships.”

What’s Going on Now?

The U.S. Bureau of Economic Analysis (BEA) recently announced that we are breaking up with expansion and officially in correction territory. Aka, we’re in a recession. Well, most likely. We will officially know in the next few weeks when GDP growth numbers are confirmed.

However, there’s a lot of speculation about if the U.S. is officially in a recession. President Biden and Federal Reserve Chair Jerome Powell say “nope” pointing to the strong labor market and rising wages. On the other hand, the U.S. Bureau of Economic Analysis (BEA) says, “probably” but we will confirm later this month. Consumers, rightfully annoyed at the discrepancy, are saying, “it’s definitely a recession.”

How long is this going to last?

Just as a football game could technically take longer than 4 quarters (going into overtime), there is a typical time frame.

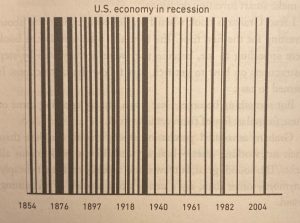

The average recession in the U.S. lasts roughly 17 months. The shortest official recession in U.S history lasted just two months in early 2020. The longest official recession in U.S. history lasted more than five years from 1873 to 1879. No one can call the timeline for a recession, but we do know that we’re getting smarter. Looking at the cart below, you can see the average duration and space between recessions.

* Originally posted by Grit Capital.

How do you play defense in a recession?

You can play defense in a few ways, but first let’s start with the basics.

- Make a playbook – When playing any sport, one of the smartest strategies you have is to assess your opponent and come up with a strategy. With finance, coming up with your own playbook can be equally as important in coming up with a “winning strategy.” Creating a strong strategy starts with understanding your current situation – what do you currently have? You want to understand the bird’s eye view of your situation so you can understand what you are working with. Then, you’ll want to understand what you are up against – maybe you are new to a job, maybe you are currently unemployed, maybe you just took out a mortgage, maybe you’re about to get married. Knowing what is upcoming can help you think through how to prepare for your future.

- Have plenty of emergency savings – I’ve mentioned in the past that your emergency savings are like underwear and without them you are unprotected. In this case, emergency savings are like your helmet. If you end up getting pushed around, your helmet is there to soften any impact. Having emergency savings during a down market is all about softening the impact of “losses” and making sure you’re protected. Typically, industry experts recommend having 3-6 months of emergency savings (your monthly expenses x 3-6). When we enter the recessionary periods, you can consider holding slightly more cash (perhaps 6-8 months). Your helmet is all about what you are most comfortable with though – there is no set rule. You’ve just got to ask yourself, how protected do you want to be?

- Cut unnecessary expenses – Unnecessary roughness is a penalty in football when a player comes into contact with another in a way that is uncalled for or unsafe – it’s completely unnecessary. During a recession, if something isn’t bringing you value, cut it – it’s unnecessary. I’m not saying cut gym memberships or things that bring you joy but rather expenses you’re not seeing value from like that random magazine subscription you never read.

How to defend yourself with investing?

- Remove Bias – When investing during down markets, you’re often your own worst enemy. When I was losing at football, I’d make reckless decisions like try to throw multiple hail mary’s (trying to get a touchdown from too far away) and most would end up in interceptions. With investing during periods of volatility, you’re going to want to make reckless decisions. You’ll see your portfolio in the red and think, “If I just buy this, then I’ll make up for all my losses.” Removing emotional decision making can help prevent you from making reckless decisions with investing even those that “feel right” in the moment.

- Don’t Call It Quits – When I was losing at football, I not only made reckless decisions, I also gave up too soon. If I stopped playing the game, then I stopped losing. With investing during periods of volatility, you’re also going to want to bail. Just the other day, I spoke with someone that said, “I should just sell and cut my losses. If I go straight to cash, I’ll be safe.” Looking back over the 20-year period from Jan. 1, 1999, to Dec. 31, 2018, if you missed the top 10 best days in the stock market, your overall return was cut in half. This is typically called “loss aversion” which is an intrinsic human behavior that means we’re more invested in preventing losses than we are in pursuing potential gains. While it might feel good in the moment, the pain long term can be much more significant.

- Consider Bonds – Bonds (fixed-income) make periodic payments over time. Whether issued by the government or a corporation, they are basically loans. If you give a company money, they will give you a bond and pay you back interest over time. They will give you the full value of interest if you hold the bond for the full term of the agreement. Therefore, bonds are typically more secure than stocks which most certainly do not have guaranteed returns (not that bonds do either, it’s just more typical). However, bonds are more illiquid – aka, if you need your money tomorrow, you may need to take a loss. Think of them as more long term. Some are even yielding records rates like I bonds that pay a 9.62% annual rate through October,

- Dividend-yielding investments – In recessions, many financial experts will recommend investing in dividend yielding stocks. The reason for this is, even if the stock is not performing, at least you are getting a kick back.

- Get smart about tax-loss harvesting – Tax loss harvesting is all about offsetting your gains with losses. During a recession, you may experience losses, so it could be in your best interest to lower your tax liability. With Aura, we do it for you!

Things to be mindful of:

- Don’t obsessively check your portfolio – It’s easy to obsess when you feel like you are losing. When I was losing at football, I’d think to myself “you’re no good at this.” I’d also constantly talk to my brothers about losing to which they’d respond, “don’t be such a sore loser.” With investing, sometimes the best thing you can do is, give it space. The space between you and your portfolio can give you clarity and prevent poor decisions and hyper-fixation.

- Stay Calm – There have been 11 recessions since 1948, averaging out to about one recession every six years. This is most likely not your first (unless there are extremely bright 5 years olds reading this… to which I’d say, whomst brought you here?) and will most certainly not be your last. Take a deep breath, flip on some football or perhaps something more relaxing, and try to enjoy the ride.

- Offense sometimes does win – I’d be remiss not to mention that some people will bet big on risky investments and win. Some will even argue, “everything is about offense these days.” No matter what strategy you believe in, it’s about what works for YOU.