When I was in college, I went through my first real breakup. We had been dating for a few years, but the distance took its toll on our relationship. When we finally parted ways, it felt like the worst pain I had ever felt. I remember calling my mom to tell her how miserable I was and how I would never recover and she would say, “You are going to get through this. I’ve been there. It’s terrible but you are going to be alright.” I would then respond, “You just don’t understand what I am going through.” She would also encourage me to get out of my dorm and do things to take my mind off the breakup. I never listened. I preferred to cry in my room, text my ex, or commiserate with friends.

Flash forward just a few years, I am in a committed and lasting relationship. I am happier than I have ever been with a partner and am indeed alright just like mom said.

WTF are you talking about?

Your first breakup is a lot like your first bear market. It’s going to be painful, you’re going to feel overwhelmed, and it’s going to seem like you’ll never recover. However, it is a natural part of life and growing up and you WILL get through it. Who knows, you might even land better off than the past.

What is a bear market?

A bear market is a 20 percent decline from the most recent market peak. Typically, when we talk about bull or bear markets, we refer to them in relation to benchmarks like the S&P 500 or DOW Jones. As of this morning, the S&P is currently down -22% YTD and the DOW is down -17% meaning we are officially in bear market territory (and technically this is not the first time we’ve crossed the -20% mark this year).

Please note, this was published as of Jun 14, 2022.

Ok, so what do a bear market and a breakup have in common?

- They are painful – Your first breakup is going to hurt. At the time, my first break up felt like the worst pain I had ever experienced. Your first bear market might feel similarly wretched. There is something about a red line that makes your heart sink into your stomach. For weeks everyone has been talking about rising inflation, the bear market, impending recessions, and downward stocks. You might have wondered at some point, “Should I be worried,” “Will my money be okay?” or even, “Will I be okay?” Short answer. Yes, you will. Down markets are incredibly stressful, especially if you’ve never experienced them. When you’re learning to ride the waves of volatility, try to think less red and more deep blue – we’re in the waves now. The best thing to do is hold on and enjoy the ride.

- They feel like forever – When I was going through my first breakup, I thought the pain would never end. However, after a few months, I already started to feel better and after a full year, I was back to my normal self. When you’re in a bear market, you might think you’ll never recover and your portfolio will always be in the red. Being in a bear market is like being in a dentist chair – it’s uncomfortable and even though it feels like it takes forever, it’s temporary. While they may feel long, the truth is that the average bear market lasts 289 days, or about 9.6 months; whereas, the average length of a bull market is 991 days or 2.7 years.

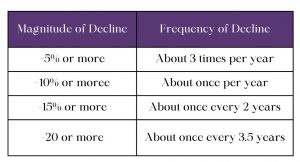

* These are characteristics of Market Corrections (based on DOW Jones Industrial Index 1900-2011).

* These are characteristics of Market Corrections (based on DOW Jones Industrial Index 1900-2011). - They are inevitable – In life, you will likely date and befriend lots of people and though those relationships might be great in the moment, they might not be the right fit for the long-term. Breakups are inevitable and so are bear markets. In fact, there have been 26 documented bear markets since 1929. Assuming a 50-year investment horizon, you are likely to live through ~14 bear markets over the course of your investment journey. Accepting the ups and downs along the way is a part of the process to finding love (and making money).

- You will rebound – After my breakup, I thought I’d never find love again. And yet, after my fair share of post-breakup rebounds that came with their own mini ups-and-downs, I met my life partner and have never been more in love. The bear market also rebounds. On February 19, 2020, the S&P 500 fell into bear market territory. The index fell 34% over 5 weeks until it rebounded on March 23, 2020. It was the shortest Bear Market ever. Yesterday, the S&P 500 dropped more than 21% landing us in Bear territory, but remember, the S&P 500 is up 54% over the past 5 years and 3,397.26% since it started.

- Winners Play the Long Game – I put a lot of pressure on my first relationship. I thought we were going to be together forever and he was “the one.” When it turned out not to be forever, I was crushed. As investors, we also put a lot of pressure on our portfolios and think we need everything, right now and to be perfect, always. Recognizing that the market takes time (just as love does) is an important part of the journey. While the returns may not be immediate, growing together over time is often worth the wait.

What’s the Difference Between a Bear Market and Recession?

A recession is a period of continuously declining economic performance across an entire economy that lasts for several months. A bear market can happen instantaneously if the “market” “corrects” (i.e. drops) 20% or more. While we have officially entered bear territory, we are not in a recession. Bear markets do not always lead to a recession. Remember, there have been 26 bear markets since 1929, but there have only been 15 recessions in this period. Throughout history, there have only been 4 times when the S&P posted consecutive year after year negative returns (1929-33, 1939-41, 1973-74, and 2000-02). What goes down, historically comes back up.

What’s Going on Now?

After Covid hit, the economy needed a big boost. Monetary policy was accommodative, meaning there was an influx of cash into the system. The Fed lowered interest rates to zero and the government stimulus plan put free money in the hands of millions of Americans. Now that things are going back to “normal”, monetary policy is becoming more restrictive. The Fed announced that they will be aggressively raising interest rates and selling assets (bonds) to bring inflation back under control.

How does this all work?

Well, when the economy stalls, the Fed can stimulate economic growth by buying up corporate bonds (essentially, the government loans money to big corporations on very fair terms) to stimulate the economy. Now, the government needs to reverse course to bring the economy back into equilibrium. So, the government is selling the corporate bonds they purchased which causes downward pressure as there are more sellers (government + corporations) than buyers (open market). As bond prices go down, interest rates go up.

Will this lead to a Recession?

I will never be one to call a recession. No one knows the future, but I consider the chances of outcomes rather than outcomes being completely black or white. I also think it’s important to learn from the past and know that recessions typically happen when the economy is in excess.

In 1999, company valuations and share prices were too high. Companies were trading at 40x their profit. The “bubble” burst when people realized people were paying too much money for future dollars. That was equity excess.

In 2008, there was too much debt on too few assets. The payments (mortgage payments in particular) were not coming in with too high of debt. This was debt excess.

Currently, valuations are within reason, corporates have healthy balance sheets, companies are not overly leveraged, and the savings rate is higher than it has ever been – we are not seeing excess like 1999 & 2008. The list of risks here are geopolitical events, supply chain issues, & monetary policy (rising interest rates).

Why Are People Freaking Out?

People are freaking out because some stocks are really blowing up. That’s when sensational news really starts to cause stress on consumer sentiment. Peloton, Netflix, Docusign, Zoom, etc. However, the broader market is only down around 20% while a few companies are outliers.

Again, we have strong corporate balance sheets and Americans have more savings than ever. Valuation multiples are fair (PE/Debt to Income). The consumer balance is healthy – Americans have savings, jobs (the labor market is strong), unemployment is low, wages are increasing. However, consumer sentiment is unhealthy. Whenever you see periods like this, it’s best to stay cautious but reasonable.

How Should I Prepare for a Bear Market?

- Think Forward – Don’t let the bumps deter you from long-term thinking. The market has soared overall since 99 and 2008. However, I have spoken to many people that experienced these downturns that affected them for years to come (ie: people that were burned by the 2008 crisis and never invested again) and those people have lost a lot, lot more in the long term. Amidst a terrible breakup, it’s easy to think you’ll never find love again, but it’s important to never lose hope!

- Breathe – Market fluctuations are stressful and stress can cause us to do irrational things. Take a walk, turn off your price notifications, and try to breathe. Overthinking and over stressing about intraday market changes can take us off the course we are meant to be on.

- Stay Diversified – When downturns happen, it can be easy to think “I need to go all in on bonds.” However, timing the market is near impossible, so staying the course, even when times get tough, is often the best way to move forward. This will also prevent you from missing out on market rebounds. Remember, time in the market is always better than timing the market.

- See Opportunity – People will often say that market downturns are like the stock market going on sale. Rather than see this period as a negative, look at it as an opportunity to buy what you’ve always wanted at a discounted price. But beware buyer’s remorse, even if you see a few more flash sales in the future, that doesn’t necessarily mean you didn’t also get a good deal.